General Opinion on Credit Cards

There has been a mixed opinion when it comes to the concept of having credit cards in India. Yeah definitely I totally agree with the point that credit cards undoubtedly has the highest interest rates in India. Highest in the sense, it can even go upto 45% as well, which is 3X higher than average interest rates. Also there are some hidden charges, yearly charges and transaction fees involved which one should carefully check when they use such cards.

How Credit Cards are Beneficial

Though there is so much rant about it, why do the rich or smart people use it?. It’s just because of the various benefits, cashbacks, and rewards associated with the card. It’s very simple, the bank tells us to take our card, use it to your limit, I’ll give you cashbacks, rewards, other benefits as per your usage and you just pay the bill before the due date which is usually 40-50 days. But you’re caught if you extend the deadline.

Making the Best Use of Credit Cards

But the sweetest point is paying it within the due date or even as soon as you finish the transaction. The transactions which you’re doing with debit cards or UPI, do the same with these credit cards and repay the card bill there itself. Congratulations, you are enjoying many benefits and also safe from the trap of credit card trap. The problem occurs only when you spend money which you can’t afford to pay later.

Various Types of Credit Cards

There are 1000s of credit cards available for various purposes like shopping, travel, flight booking, fuel, dining and many such kinds in the market. If you’re someone who frequently travels by train, then you’re at the right place. This is all you should know about the new HDFC IRCTC Credit Card specially for the ones who spend a lot on traveling in trains every now and then.

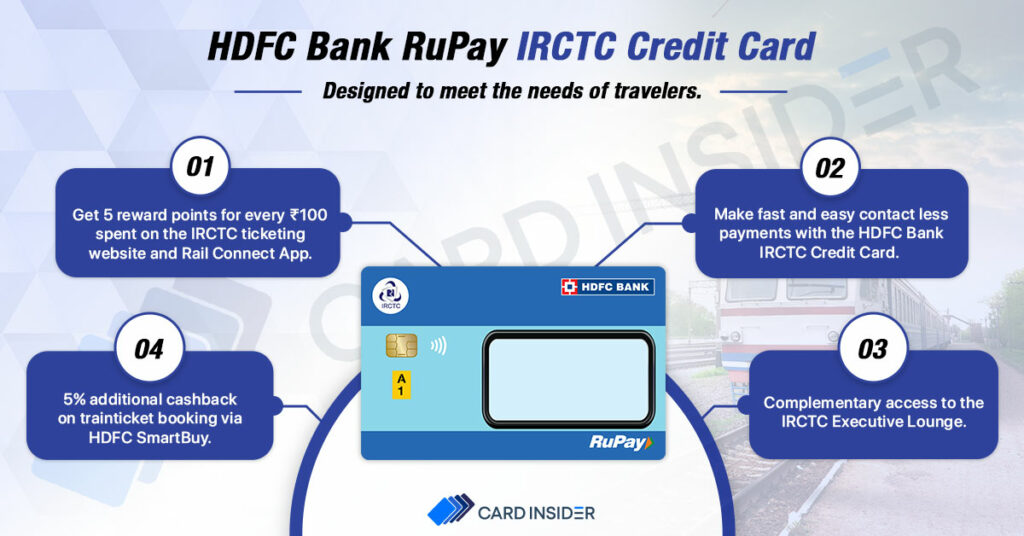

HDFC IRCTC Credit Card

This is basically a co-branded credit card of HDFC and IRCTC. There are actually many co-branded cards of IRCTC with BOB, SBI, but I was not happy with their rewards rate, AC tickets rule, seasonal rewards rule. But this card removes all those troubles. The reward rate is pretty high and also one can access IRCTC premium lounges in various railway stations of our country.

Various Fees and Penalties

The fees of the card is pretty lesser, where the joining fee is Rs 500 and every year renewal fee is the same as well. The yearly fee is waived off if you spend more than 1.5L in a calendar year. Also once you activate your card and make your first transaction, you get a voucher worth Rs 500 like welcome benefit, which means that the card is free for the first year.

The late payment charge is 3.6% pm, which is 43.2% pa. This is something which you should be careful about.

Eligibility Criteria

To be eligible for this card in India, one should be either a salaried or self-employed individual. The age limit is between 21 to 65 years of age. Minimum salary must be greater than 25,000 for salaried and 6LPA for self employed.

The application process is very straightforward. I could get the card approved in just 7-8 working days. I received the card just today and the process was very smooth. If you have a very good credit score and salary with appropriate documents, this should be fine. You need not be a previous user of HDFC to get the card, even though I am using a HDFC product for the very first time.

Benefits

The main part of this HDFC IRCTC card is the benefits, which we’ll discuss now.

- You get 5 reward points on every 100 Rs spent on IRCTC Web or App which is like 5% cashback, which can be redeemed on HDFC Smartbuy. Apart from that, one can also earn cashback when you use this reward points on Smartbuy

- If you book your rail ticket on HDFC Smartbuy, then you get an additional 5% cashback.

- Every other transaction will fetch you 1 reward point per 100 Rs spent, which is 1% kind of cashback. (1 reward point = 1 Rs on HDFC Smartbuy)

- The 1% transaction fees is waived off on the tickets booked with IRCTC

- Apart from IRCTC, there are many offers going on on HDFC credit cards on various portals and offline shopping. This card would be very beneficial there as well.

IRCTC Lounge Delhi - There are 8 complimentary lounge access per year (2 per quarter) every year, which is the best part of this card. Supplementary members also can avail this benefit and 2Rs would be charged to verify this card. These are the facilities you get, whenever you visit an IRCTC lounge

- Two Hours of IRCTC Executive Lounge stay

- A/C comfortable sitting arrangements

- Access to washrooms / changing room

- 1 Buffet meal- Breakfast, Lunch or Dinner as per the time of visit.

- Unlimited tea & coffee

- Free Wi-Fi

- Charging points

- Newspaper and Magazine

- So in total on every railway ticket you book, you get a reward of 11%, which is a very great deal.

- You get a gift voucher worth Rs. 500 on reaching the retail spending milestone of Rs. 30,000 every quarter or every 90 days.

- 1% fuel surcharge is waived off on transactions between Rs. 400 and Rs. 5,000.

- Welcome benefit of Rs 500, making the card free for first year

These were the benefits of this card. The most interesting part is the lounge access where for 2 hours of access with a meal costs more than 500 and you’re getting that for free, which is a great deal. These lounges are available in New Delhi, Jaipur, Agra, Ahmedabad, Sealdah, Madurai, Varanasi, Asansol, Durgapur and many cities would be added in the coming days.

Drawbacks

You shouldn’t take this card if you’re someone who doesn’t spend much on IRCTC as the reward rate on all other spends is literally very less. There are similar cards of MakeMyTrip, Goibibo which give an overall 5% cashback on total travel spends, which would be better for traveling. But compared to other IRCTC credit cards, this would be the ideal one. Also the annual charges are also pretty less, which makes it pretty attractive.

Conclusion

Though I already have a SBI Cashback Card which gives 5% cashback on all online spends, but not on rail tickets, this would be beneficial for spends on IRCTC and lounge access. Had I got this card last year where I spent around 50-60k just on train bookings where I also had been to New Delhi, Madurai, Jaipur railway stations multiple times, I could have used the lounge and delicious meal as well. So this was about the HDFC IRCTC Card, if you wish to review any other credit cards or need any details of this card, comment down below. If you wish to apply for this card, click on this link – Click here

Get 11% Off On Your Rail Tickets : Here’s Everything You Need To Know About HDFC IRCTC Credit Card – VentureVista